-

南昌是中国东部的一个城市,近年来经历了房地产的繁荣,一排排高耸的建筑在赣江两岸林立。然而,这种情况现在已经结束了,使该城市的空置率高达20%左右,房地产市场陷入危机。这暴露了该市不计成本的增长方式的裂缝,许多新建的公寓由于开发商没钱而仍然空置。

-

中国共产党已经被房主拒绝支付抵押贷款,直到他们的公寓完工,北京和地方政府现在正试图通过放松贷款限制和向购房者提供奖励来恢复经济。去年,中国70个最大城市的新房价格有所上升,但这种反弹是不均衡的,北京和上海等大城市的复苏比南昌等二、三线城市的复苏更明显。

-

尽管中国政府做出了努力,但南昌的房地产市场仍然处于危机之中,因为该市仍然留有很高的空置率,而且已经售出的单位的完工率仍然没有保证。这凸显了政策制定者在试图振兴中国经济时面临的巨大挑战,因为房地产和基础设施支出可能不足以解决这一次的情况。

-

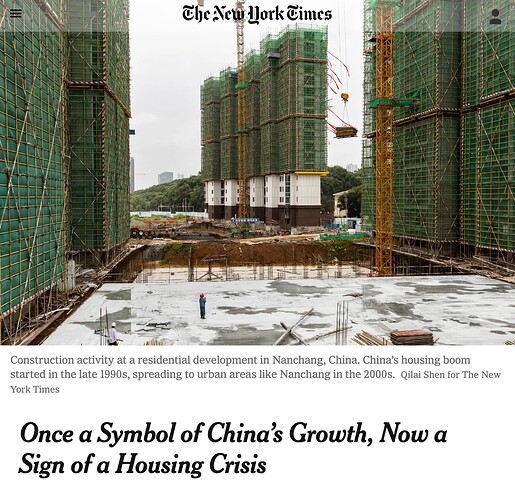

中国的住房热始于1990年代末的大城市,然后在2000年代蔓延到南昌等小城市地区。到2010年代中期,中国每年建造700多万套公寓,为中国人创造就业机会并提供投资选择。然而,包括南昌在内的许多城市的建设超过了人口增长的承受能力,导致住宅空置率达到20%。

-

北科研究会的一份报告发表后,显示了中国房地产困境的程度,该报告被删除。南昌的经济传统上依赖制造业和建筑业,并试图引入高薪的数字经济和技术行业工作,但没有取得多大成功。该市的高楼数量与北京相同,但人口和经济产出只有北京的一小部分。

-

房地产经纪人匡伟说,自2019年以来,该市较偏远地区的房价已经下降了25%,他预计房价将进一步下降。他的大多数客户仍然拒绝降价,希望市场能够回升。然而,由于办公室空置率高达40%,南昌房地产市场的未来仍然不确定。

-

28岁的Cinderella Fang在南昌出生和长大,她童年的家附近的地区已经变成了一大片30层的公寓楼。在北京上完大学后,她回到南昌,希望能找到一个负担得起的房子,但只能找到一份工资是她在北京的三分之一的工作,所以她搬到了上海。在上海生活和工作的Andie Cao在南昌买了一套未完工的公寓,但开发商遇到了财务问题,并在2021年7月停止施工。

-

曹女士说,销售人员误导她说公寓位于南昌较成熟的地区之一,有很好的学校,实际上它被划到了该市郊区的一个邻近的欠发达地区。去年7月,她和其他房主上演了一场抵制抵押贷款的戏码,现在银行正在起诉她的一些抵制邻居。

-

南昌的一名房地产经纪人邹胜基说,关于未完工公寓的负面宣传使许多潜在的购房者 “害怕和担心”。在5月初的劳动节假期期间,通常是房屋销售的繁忙时期,他的团队只卖出了不到20套公寓,而两年前同期的数量是这个数字的三倍。客户不愿意购买,因为目前房地产感觉风险太大。

-

Nanchang, a city in eastern China, has undergone a real estate boom in recent years, with rows of towering buildings lining the banks of the Gan River. However, this has now come to an end, leaving the city with a high vacancy rate of around 20% and a real estate market in crisis. This has exposed the cracks in the city’s growth-at-all-costs approach, with many of the newly built apartments remaining empty due to developers running out of money.

-

The Chinese Communist Party has been rattled by homeowners refusing to pay mortgages until their apartments are finished and Beijing and local governments are now trying to revive the economy by loosening lending restrictions and offering incentives to home buyers. New-home prices have risen in China’s 70 biggest cities over the last year, but this rebound has been uneven, with bigger cities like Beijing and Shanghai seeing more of a recovery than second and third-tier cities like Nanchang.

-

Despite the efforts of the Chinese government, the real estate market in Nanchang remains in crisis as the city is still left with a high vacancy rate and the completion of already-sold units is still not guaranteed. This highlights the enormous challenges policymakers face in trying to revive the Chinese economy, as real estate and infrastructure spending may not be enough to fix the situation this time around.

-

China’s housing boom started in the late 1990s in the biggest cities before spreading to smaller urban areas like Nanchang in the 2000s. By the mid 2010s, China was building more than seven million apartments a year, creating jobs and providing investment options for Chinese people. However, many cities, including Nanchang, saw more construction than population growth could sustain, leading to a residential vacancy rate of 20%.

-

After the publication of a report by Beike Research Institute, which showed the extent of China’s real estate woes, the report was deleted. Nanchang’s economy traditionally relied on manufacturing and construction, and have tried to bring in higher-paying digital economy and technology industry jobs without much success. The city has the same number of tall buildings as Beijing, but only a fraction of the population and economic output.

-

Real estate agent Kuang Wei said prices in the more remote part of the city have declined 25% since 2019, and he expects them to fall further. Most of his clients still refuse to cut prices, hoping the market will rebound. However, with a 40% office vacancy rate, the future of the real estate market in Nanchang remains uncertain.

-

Cinderella Fang, 28, was born and raised in Nanchang, where the area near her childhood home had transformed into a sprawl of 30-story apartment complexes. After going to university in Beijing, she returned to Nanchang hoping to find an affordable home, but could only find a job that paid one-third of what she made in Beijing, so she moved to Shanghai. Andie Cao, who lives and works in Shanghai, bought an unfinished apartment in Nanchang, but the developer ran into financial problems and stopped construction in July 2021.

-

Ms. Cao said the salespeople had misled her about the apartment being in one of Nanchang’s more established districts with good schools, and it was actually zoned for a neighboring, less developed area on the city’s outskirts. She and other homeowners staged a mortgage boycott last July, and the banks are now suing some of her boycotting neighbors.

-

Zou Shengji, a real estate broker in Nanchang, said the negative publicity about the unfinished apartments had left many potential home buyers “afraid and worried”. During the Labor Day holidays in early May, usually a busy time for home sales, his team sold fewer than 20 apartments, compared to triple that amount in the same period two years ago. Clients are reluctant to buy because real estate feels too risky at the moment.