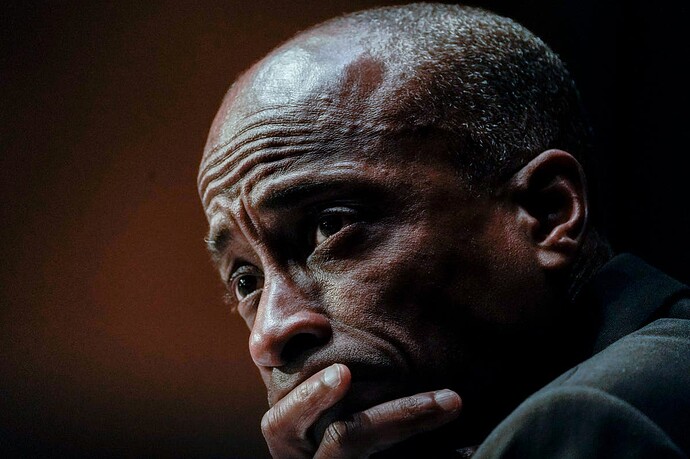

Colin Luther Powell, known simply as Colin Powell, is an American statesman and retired four-star general in the United States Army, who served as the 65th United States Secretary of State, under the administration of President George W. Bush, from 2001 to 2005. He is renowned for his military service and his contributions as a political figure, globally.

Early life and education

Colin Powell was born on April 5, 1937, in Harlem, New York City, to Jamaican immigrant parents, Luther and Maud Powell. He grew up in the South Bronx, where he went to Morris High School. Upon graduation, he attended the City College of New York (CCNY), where he earned a Bachelor of Science degree in geology, in 1958.

Military career

Upon graduation from college, Powell joined the Reserve Officer Training Corps (ROTC), and upon completion, he was commissioned as a second lieutenant, in 1958. Powell served in the US Army for over 35 years, rising through the ranks to eventually become a four-star general, serving in various positions throughout his career.

Powell served two tours of duty in Vietnam, where he received a Purple Heart for injuries sustained during his second tour. From 1987 to 1989, Powell served as the National Security Advisor to President Ronald Reagan. Later on, he was appointed as the Chairman of the Joint Chiefs of Staff, a role he held from 1989 to 1993, during which time he played a significant role in the Persian Gulf War.

Political career

In 2001, Colin Powell was appointed by President George W. Bush as the 65th US Secretary of State, a position he served in from 2001 to 2005. Powell’s appointment as Secretary of State made him the first African American to hold the position. He was also one of the highest-ranking African American government officials in the history of the United States.

During his time as Secretary of State, Powell played a vital role in the Bush administration’s response to the September 11 terrorist attacks, including the decision to engage in the wars in Afghanistan and Iraq. Powell gave a speech to the United Nations in February 2003, outlining a case for the invasion of Iraq, using evidence later proved to be flawed.

Political views and affiliations

Powell has long been considered a moderate within the Republican Party, and is known for his more centrist views on a number of issues. He has been a vocal opponent of the Republican Party’s hard-line stance on social issues such as abortion and same-sex marriage, and has voiced support for affirmative action and immigration reform.

In recent years, Powell has become increasingly critical of the Republican Party and its direction under the leadership of Donald Trump. In a 2020 interview, Powell stated that he could not support Trump’s re-election and endorsed Democrat Joe Biden for president.

Personal life and legacy

Powell has been married to Alma Johnson since 1962, and they have three children. Powell is known for his philanthropic work, establishing the Colin Powell School for Civic and Global Leadership at his alma mater, the City College of New York.

Powell has received numerous awards and honors over the course of his career, including the Presidential Medal of Freedom, the Defense Distinguished Service Medal, and the Legion of Merit. He is widely regarded as one of the most respected and significant political figures of his generation, and has been noted for his leadership qualities, diplomatic skills, and commitment to public service.

Disclaimer

6do Encyclopedia represents the inaugural AI-driven knowledge repository, and we cordially invite all community users to collaborate and contribute to the enhancement of its accuracy and completeness.

Should you identify any inaccuracies or discrepancies, we respectfully request that you promptly bring these to our attention. Furthermore, you are encouraged to engage in dialogue with the 6do AI chatbot for clarifications.

Please be advised that when utilizing the resources provided by 6do Encyclopedia, users must exercise due care and diligence with respect to the information contained therein. We expressly disclaim any and all legal liabilities arising from the use of such content.